Close window | View original article

National Debt: The First Shoe Drops

First Europe; eventually, America.

Back in the day when city people lived in ill-constructed tenement apartments, you could always tell when your upstairs neighbor was getting ready for bed. First, they'd creak across the ceiling of your bedroom over to the bed. Then, you'd hear the first shoe go "clunk" against the floor as they kicked it off and let it fall. It was futile to try to go to sleep before you heard the second shoe drop because that second "clunk" would wake you up again. Hence, the downstairs-dweller would be stuck waiting for the other shoe to drop, unable to relax and go back to sleep.

For many years, those of us who are able to add up total government debt and subtract national income as taxpayers lose their jobs to globalization or to the Obama depression have been warning that our nation is on a spending path that simply can't go on forever. Twenty years ago, we were laughed at - "Of course, we'll pay everybody's Social Security - it's required by law!" As more and more people began to catch on to the reality of the coming fiscal train wreck, we were accused of meanness for wanting to slash all those hard-earned government pensions and health benefits.

The First Shoe

At long last, the New York Times is writing about the coming financial crisis. They've dropped the first shoe, and not before time.

The teaser for their lead story of May 23, 2010 was, "The deficit crisis that threatens the euro along with an aging population and low growth has undermined the sustainability of Europe's standard of social welfare."

This sentence, while perfectly true, ranks up with Japanese Emperor Hirohito's observation following the nuking of Hiroshima and Nagasaki that "the war in the Pacific has proceeded not necessarily to our complete advantage." Talk about an understatement! We'd say "annihilated" rather than "undermined" or the Emperor's more convoluted expression.

As with Hirohito's remark, however, at least the Times is taking an essential step in the direction of reality. The article titled "Payback Time - Europeans Fear Crisis Threatens Liberal Benefits," says:

Europeans have benefited from low military spending, protected by NATO and the American nuclear umbrella. They have also translated higher taxes into a cradle-to-grave safety net. "The Europe that protects" is a slogan of the European Union.

Americans have known for a long time that our defense spending has made it possible for Europe to get a free ride, but even that subsidy is not enough to preserve the European welfare system.

With low growth, low birthrates and longer life expectancies, Europe can no longer afford its comfortable lifestyle, at least not without a period of austerity and significant changes. The countries are trying to reassure investors by cutting salaries, raising legal retirement ages, increasing work hours and reducing health benefits and pensions. [emphasis added]

Anybody who thinks about the situation for very long realizes that no government can spend more money than it collects in taxes forever - something has to give when lenders won't lend any more. As Margaret Thatcher put it, "Eventually you run out of other people's money."

The reaction so far to government efforts to cut spending has been pessimism and anger, with an understanding that the current system is unsustainable [emphasis added]

Much as we'd like to believe that Europeans understand that their system can't go on, the riots in Greece and the union-driven protests in France suggest that most people who benefit from the current system are in no mood to consider cutting their benefits. Although polls say that a majority of French citizens agree that the current pension system must be changed, they oppose cutting benefits or raising the retirement age. If you can't impose either of those fixes, what can you do?

|

|

| The coming train-wreck |

|---|

Here's the Rub

There are two fundamental problems:

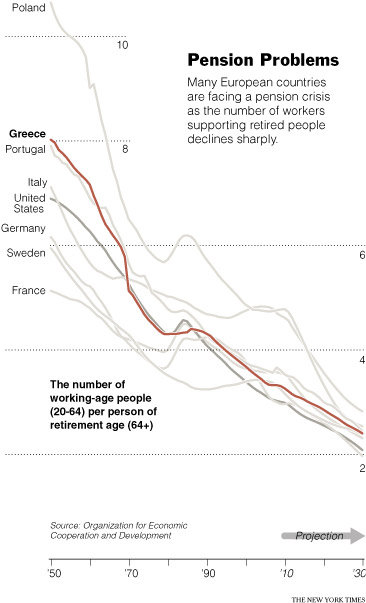

People are living longer than they used to - instead of collecting for 3 or 4 years, retirees collect for 30 or 40 years.

Today's retirees had too few children to sustain the system.

The graph makes the coming crisis all too clear - it would take a 25% pension-tax rate for two workers just to support one retiree at 50% of final pay, and that simply can't happen. Even if it could, many public-sector pensions pay more than the employee earned while working. That would require a 50% tax on two workers just for pension purposes - plus whatever else government wanted to spend on everything else. When something simply can't go on, it won't.

Will They Drop The Second Shoe?

The Times' article describes the situation in Europe, of course. They're not yet ready to point out that American finances are in equally bad shape. Mixed in with all the articles about the Greek overspending crisis, we've seen many which claim that America is not Greece and that our deficits are far more manageable. These articles generally claim that we're in good shape because the American deficit is about half of annual GNP whereas Greek debt is more than their annual GNP.

This lie omits the awkward fact that, assuming that we actually intend to honor our commitments to retirees and the newly-insured who expect to benefit from Obamacare, our total future obligations far exceed our annual GNP. We don't know how much bigger Greece's debts are than have been publicly disclosed - politicians love to lie about what they've promised to spend in the future - but the hidden obligations we've taken on put us in worse shape than Greece.

The Wall Street Journal points out that the Taxed Enough Already (TEA) party and the government employee unions are the two biggest players in the coming November elections. Even though public sector pay is about 30% greater than comparable jobs in the private sector, our government unions aren't any more eager to see their pensions and benefits cut than the Greek or French unions who're leading the riots.

On the other hand, the Tea Party people have seen our current government-inspired depression annihilate their retirement investments. They don't like seeing their retirement benefits disappear any more than unions enjoy pension cuts and they aren't eager to pay for the pensions and benefits the politicians promised the unions. The tea parties seem to have been triggered by the prospect of paying for Obamacare while watching their own health care fall apart, but they're also beginning to see that the other government entitlements are equally unaffordable.

Although the New York Times includes labor unions when complaining about "special interests" who control Albany and keep spending high, they haven't written much about the looming liabilities we're facing with respect to public pensions that were negotiated in the past. California, New Jersey, Michigan, Illinois, and New York are facing debt-to-income problems which are comparable to the numbers which triggered the Greek crisis.

The rest of Europe created a trillion-dollar fund to help bail out the free-spending Greeks, Portuguese, Spanish, and Italians. A major portion of Mr. Obama's trillion-dollar stimulus went to state governments so they wouldn't have to cut government employee pay, but that's not likely to happen again.

Will the Second Shoe Fall?

The outline of the coming train wreck has been obvious for many years. The Times has dropped the first shoe in pointing out the magnitude of the coming European disaster. Will they drop the second shoe and explain that America faces the same problem? Or are they afraid that if the Tea Party folks understood the full magnitude of the coming government-inspired disaster that they'd vote all the rascals out?