Close window | View original article

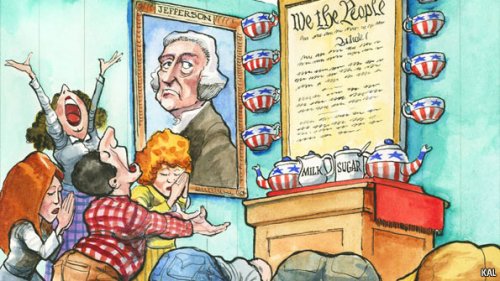

The Left Discovers the Constitution

Yes, Obama can recess-appoint Elizabeth Warren - and he should.

Most Americans have not noticed, but the current dispute between Mr. Obama and Congress over the war in Libya is not our only constitutional collision. A less heated, but in some ways more interesting, dispute has arisen over Mr. Obama's appointment of Elizabeth Warren to head the new Consumer Financial Protection Bureau (CFPB).

Who, to head what? First, a brief summary.

As we've explored at length, our current financial woes were mostly caused by government malfeasance and misregulation where banks were strong-armed into giving loans to people who could not afford to pay the money back. Not wanting to lose money, of course, the bankers made sure to put high interest rates on those impossible loans, and wherever possible, to sell them to government-backed Fannie Mae and Freddie Mac so they wouldn't be left holding the bag.

George W. Bush tried to reform Fannie and Freddie, but since those groups made loans to Democrat constituents and provided monster salaries to Democrat grandees, congressional Democrats stymied his attempts. To be fair, he had other things on his mind and didn't push as hard as hindsight shows that he should have.

Come the financial crisis, it became obvious to everyone that big loans to people with no job, income, or assets (NINJA) were a Bad Idea. Rather than blame the people who fraudulently took the loans or the regulators who cared more about the color of borrowers' skin than the color of their money, the Democratic Congress and the media blamed greedy bankers. Bankers wanting to make money instead of lose it - what a shock!

In a classic case of presenting a cure worse than the disease, Nancy Pelosi and Harry Reid passed the Dodd-Frank financial reform act, named after and created by exactly those two politicians most responsible for causing the disaster in the first place. Among other things, this act created a new Consumer Financial Protection Bureau (CFPB), intentionally modeled after the Food and Drug Administration. Just as the FDA is supposed to protect us from harmful drugs and tainted food - but instead, actually prevents us from enjoying useful new cures - so is the CFPB intended to protect us poor helpless innocents from "unhealthy" financial products.

Personnel Is Policy

To head this agency President Obama appointed Prof. Elizabeth Warren, a noted law professor and bestselling author. Republicans immediately reacted with horror, convinced that Prof. Warren intends to destroy Wall Street and banking as we know it.

Mr. Obama has the right to appoint whoever he can get the Senate to confirm, and his Democrats control the Senate. Republicans could and did filibuster Warren's appointment, but should the Senate adjourn, the Constitution gives the President the power to make a recess appointment. The Fourth of July holiday is fast upon us; the long weekend gives Mr. Obama the required adjournment he needs to plop Warren into her seat.

Not so fast! Our current Congress, for the very first time, read the Constitution aloud; clearly Speaker Boehner was listening and paid special notice to Article 1, Section 5:

Neither House, during the Session of Congress, shall, without the Consent of the other, adjourn for more than three days, nor to any other Place than that in which the two Houses shall be sitting. [emphasis added]

Bingo! Problem solved! All Speaker Boehner has to do is not allow the Senate to adjourn. Mt. Obama then can't make his appointment, and Prof. Warren will remain exiled from power and have to continue languishing in the hallowed halls of Harvard.

The interesting thing about this dispute is that, under other circumstances, we would applaud Prof. Warren being given a position of influence; she has highly valuable and worthwhile things to say. She co-wrote the excellent and best-selling The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke, which we strongly recommend to readers of Scragged.

Two Incomes is Not Enough

The Two-Income Trap explores the subject of why American middle-class families are having a desperately hard time making ends meet while working harder and harder. Several decades ago, a working father earned enough money to keep his family in comfort and his wife at home. Today, most middle-class families must have both parents working, yet their lifestyles are not particularly better than those of their parents. Certainly they're less secure.

Prof. Warren identifies several causes of the problem, some of which we've explored ourselves in the pages of Scragged: collapsing and ever-more-costly public schools, expensive housing restricted by zoning ordinances and building regulations, and especially the supply-and-demand problem of dumping women into the workforce without a corresponding increase in the amount of work needing to be done.

If you nearly double the supply of labor by taking women out of the home, obviously the price of labor is going to fall. The more the price of labor falls, the harder it is for a working father to provide for his family by himself; the pressure will build for the wife to join him at work. When she does, while solving the family's immediate cash crunch, her presence makes the labor oversupply even worse.

In her book, Prof. Warren also heaps blame on bankers for encouraging unwise loans on onerous terms. She includes a gripping narration of a scene in which she and her co-authoress met with high banking executives, begging them to stop flogging high-interest credit cards and ARM mortgages to people who can't afford to pay them back. Her argument seems to be about to carry the day, until the most senior member of her audience points out that most of the bank's profits come from just such overpriced and "exploitative" products.

Greed ends victorious, and Prof. Warren goes to D.C. to convince Congress to outlaw "unhealthy" financial products - the end result being, of course, the CFPB she's now on track to head.

Smart People Can Be As Wrong as Anyone Else

The error Prof. Warren makes is the same ones that all nanny-staters, elitists, and anti-freedom tyrants do: she seems to believe that normal Americans have not the intelligence or the discipline to know what financial products are good for them and which aren't.

We boneheaded, ignorant subjects require a better, wiser, more evolved and advanced person - such as herself, naturally! - to tell us what's good for us. No doubt she gets on well with Michelle Obama, who wants to tell us what we are to eat while scarfing down all the fattening food she desires.

Prof. Warren views loans as drugs - appropriate only with a prescription from a suitable authority with proper government-approved credentials. You can't just go buy pills for your flu, oh no - you have to go see a doctor and get a prescription for them. In much the same way, Prof. Warren would have us only allowed to get the loans she feels are healthy. After all, hasn't the government done such a spectacular job of running the economy for lo these many years?

Of course, the good professor only takes her logic so far. Her book spent fewer pages demonstrating that banks need regulating than she spent clearly demonstrating why sending all our women into the workforce was a Bad Idea - the working man of the 1970s earned enough to take care of his family without his wife working, whereas today both have to work to barely equal what one made alone 40 years ago.

Should the government therefore make it illegal to hire women, or illegal for mothers to work? One supposes Prof. Warren would disagree, but we'd love to see her appointed as head of the Department for Sending Women Back to the Kitchen.

Hey, it's the exact same argument, from her very own selfsame book! If it's right for government to interfere in the one type of private choice for the presumptive betterment of all, why not the other?

The Constitution Above All

No doubt the Senate Democrats were just as startled by Boehner's knowledge of the Constitution as Prof. Warren would be by our preceding paragraph's logical tour de force. However, while our lefty friends may not like the idea of obeying the Constitution, they still can read it, and one has done so:

[The President] shall from time to time give to the Congress Information of the State of the Union, and recommend to their Consideration such Measures as he shall judge necessary and expedient; he may, on extraordinary Occasions, convene both Houses, or either of them, and in Case of Disagreement between them, with Respect to the Time of Adjournment, he may adjourn them to such Time as he shall think proper.

Spot on! If Mr. Obama feels strongly enough, and if the Senate wants to adjourn but Boehner won't let it, he can order the adjournment and make all the recess appointments he pleases. It's right there in black and white in the Constitution; as the author of the cited blog wrote to the President:

Unless at least four senators change their minds, thereby providing the 60 votes necessary to hold a simple majority vote on a nomination, you will need to make a recess appointment to secure a director of the CFPB.

I urge you to nominate Prof. Warren to head the CFPB and, if House obstructionism makes it necessary, to use your adjournment power so that you can appoint her during a Senate recess.

We couldn't agree more. It is absolutely proper for the President to exercise the powers granted to him in the Constitution.

In fact, we can't think of a better precedent for his administration and the American people: the details of the Constitution do in fact matter, and we are all obliged to follow them. If you have something you want to do, go read the Constitution and find out the way to do it.

That would certainly be a first for all too many of our politicians of both parties; Prof. Warren as (temporary) head of the CFPB would be a small price to pay for a pointed reminder that the oath to "preserve, protect and defend the Constitution" actually means something.

Please, please, Lefties, don't throw us into this briar patch! Perhaps newly-anointed Chairperson Warren's first task can be to discern precisely where in the Constitution the federal government is granted the authority to interfere with financial contracts between two private parties, much less to arbitrarily ban them.