Being Thankful for the Left Coast

Contrasting examples are good for us.

-

Tools:

Today is Thanksgiving, and in keeping with our tradition we discuss something for which, as Americans, we can all give heartfelt thanks.

The obvious candidate, of course, would be the "electoral restraining order" issued against our Socialist-in-Chief Barack Obama. But quite frankly, as grateful as we are for this urgently needed brake on our rush to statist tyranny, the recent Republican victory was only the merest of beginnings.

One year ago, we gave thanks for President Obama. We were grateful because by giving America an undiluted taste of neo-Marxist socialism, he awakened the vast sleeping middle of the country by cramming its nauseating flavor down their throats. The repudiation visible even then is unmistakable now, and, we trust, will continue to build in strength and force.

An ongoing reminder is always in order, though, as Americans are an easily-distracted people. It's possible that the new Republican Congress will be so successful in stopping Mr. Obama's agenda that the economy will recover enough for the mainstream media to falsely credit Mr. Obama with bringing about prosperity.

Fortunately for the nation, the people of California have ensured that the socialist dream will continue unabated in their unfortunate state: They have placed in office Governor Jerry "Moonbeam" Brown who presided over the Golden State's customized edition of Carter's stagflationist misery that it's taken three decades for Californians to forget. Things must be too good for Californians: they want another helping of government-grown misery from the very governor who, three decades ago, put California on the track to bankruptcy.

|

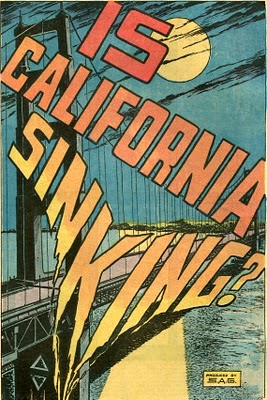

| Why, yes. Yes, it is. |

The State of California is plainly collapsing under the weight of the exactions of unionized government employees. How did this come to pass? In 1978 Gov. Jerry Brown signed legislation allowing public-sector workers to unionize for the very first time, even though no less a labor luminary than George Meany said, "it is impossible to bargain collectively with government."

What's wrong with unionized public workers, you ask?

In a normal company, there is an inevitable conflict between management and any unions. The unions naturally enough want more pay; management knows that pay increases come out of profits and future growth so they try to oppose them.

Generally they meet somewhere reasonable in the middle. Occasionally the union goes out on strike, in which case management either hires cheaper replacement workers or sweetens the deal.

In no case can management pay workers more than they are worth, however, at least not for very long; if the company is not able to make enough money to pay the union wages it goes out of business. This is an automatic death sentence to that particular greedy union local, and there's not much good for the executives at the helm when the ship sinks either.

Public-sector unions have no such automatic check-and-balance. They can merrily demand whatever wages they think they can get, and their "bosses" in the legislature can merrily give it to them because government workers do not have to do anything productive. Not enough money? Just extract more taxes at the point of a gun! That's why in 2009, total federal worker compensation including benefits averaged $123,049, or double the private-sector average of $61,051.

Epitaph for Public Sector Unions

Thus we see the corrupt "iron triangle" of union-based politics. The public-sector workers are forced into unions whether they like it or not, and are forced to pay union dues whether they want to or not.

The unions bosses take the millions of extracted dues and, after skimming off enough to support a lavish lifestyle, invest the remainder in electing Democrats.

The elected Democrats who benefit from union largess naturally tend to be loyal to the desires of their paymasters. What do union bosses want? Two things: more (unionized, dues-paying) government workers and higher salaries for them, the public be damned.

The inevitable consequence is ever-higher taxes to pay the union bill and ever more constrictive regulations to boot - after all, all those useless government minions have to find some means of apparently justifying their existence.

So, on the verge of collapse and bankruptcy, with businesses and the productive fleeing California only to be replaced by welfare leeches and illegal immigrants, what did California voters do? The voters chose the obvious solution - and doubled down. They picked a governor who is not only wholly owned by the unions and committed to securing their ill-gotten gains come what may, he was the very selfsame governor who created the problem in the first place before many of today's voters were even born.

Jobs and employers are fleeing California because it has the worst business climate in America. The voters responded to their concern by crushing an attempt to halt the economy-demolishing (and entirely fraudulent) "Global Warming Act of 2006" and picked a governor dedicated to its wholehearted enforcement.

Last time Jerry Brown ran the state, his unofficial motto was If you don't build it, they won't come; this time around, it's more "Destroy it and they'll go away." Which taxpaying Californians are, in droves.

In New Jersey, Gov. Chris Christie is providing a case study of how to save a collapsing, bankrupt, utterly corrupt, union-infested state. There's no education like a contrast: Gov. Jerry Brown in California is kindly providing one and it looks like Gov. Cuomo in New York will help him drive the point home. We trust that the Tea Partiers will make sure that all America is kept informed of the difference as noisily and as vividly as possible.

We have friends and relations in California for whom we grieve. For them, the only grounds for thanks is the wisdom of our Founders in establishing a federal republic - so they can move to another less mis-governed state, as we've been exhorting them to do for years.

For the rest of us, however, California's cautionary tale will be a daily reminder of why unions, liberals, statists, and Democrats must be stopped and driven from power whatever the cost. Thank you, California - and thank you too, and so much more, Founders!

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

This article makes me wonder who should be thankful for George W. Bush...

Another example of rank American stupidity. You people are complete morons. Or you could simply be tools of the fascist right, but I am giving you the benefit of the doubt that you really believe the nonsense you spout here, and so: Morons! Must be.

The Times thinks Brown will save money:

The Tao of Moonbeam

Jerry Brown might be just the penny-pincher California needs in a governor.

http://opinionator.blogs.nytimes.com/2010/11/17/moonbeam-to-the-rescue/?nl=todaysheadlines&emc=ab1

In choosing the oldest man ever to run the young state of California, voters decided that a grumpy penny-pincher is just what they need at a time when the state is so broke it cannot fix park benches or investigate burglaries.

Jerry Brown — welcome back! The man who eschewed the governor’s mansion to sleep on a mattress on his apartment floor when he ran California a long generation ago should feel right at home in the poorhouse of Sacramento 2010. Here’s what your outgoing governor, Arnold Schwarzenegger, had to say while trying to keep the lights on and foreclosure buzzards at bay:

“Our wallet is empty. Our bank is closed. Our credit is dried up.”

The only thing not in short supply, it seems, is California schadenfreude. The Golden State has become the American France — everyone professes to despise it, but loves to go there.

Consider: even in the last year, when 2.2 million Californians were out of work, the state added more new residents than the entire population of Pittsburgh. And about 335 million visitors came. The message from the seven out of eight Americans who do not live in California is: we love you, and enjoy watching you suffer.

The 72-year-old Brown brings a perfect background to the triage operation he will undertake in the first week of January, when he will begin a long-interrupted third term as governor.

First, he has that missionary zeal for lost causes. Remember, he was studying to be a priest at a Jesuit seminary when his father became governor in 1959 and ushered in the glory years of California as a nation-state. Over the next half-century, young Brown lived a half-dozen lives — Yale Law school, two terms as governor, three runs for president, mayor of Oakland, attorney general — and the state entered a ragged period of self-doubt. During the greed-is-good era of the late 1980s, Brown found himself ministering to the sick and dying at Mother Teresa’s hospice in Calcutta.

Second, business-minded outsiders may sound good on paper, but they don’t work well as politicians. Schwarzenegger promised to bring his Hollywood deal-maker’s muscle to Sacramento. In the end, he was without allies, and he leaves California in tatters. This year, Brown destroyed his opponent, the profligate billionaire and political neophyte Meg Whitman, with an ad that showed her mouthing the same “run the state as a business” homilies as the failed Governator.

“We need someone with insider’s knowledge,” Brown said, with Zen clarity, “but an outsider’s mind.”

Also, unlike Schwarzenegger, Brown is not dyeing what little hair he has left or pumping up his pecs to impress the babes. California needs someone to act his age, and Brown has settled into his senior years without illusions.

“Old people have a lot of good ideas,” he said on the campaign trail, another bit from the Tao of Moonbeam.

Third, Brown has long been a tightwad. O.K., he does live in a $1.8 million home in Oakland Hills with his wife and confidante, Anne Gust Brown, a former Gap executive. But he’s never lost the Costco-buyer’s view of the world. During one of his runs for president, he called for a Constitutional amendment forcing a balanced federal budget. He was an angry, mildly kooky Tea Partier before there was an angry, very kooky Tea Party.

“The truth is, I don’t like to spend money — not my own, and not the taxpayers’,” he said during the campaign. “If you want frugality, I’m your man.”

He reinforced this view during his first press conference after routing Whitman, who spent $141 million of her own money — more than any person in American history has ever spent on a single political race. He noted that the voters were in a sour mood, even turning down a proposal to raise car license fees by $18 to fund state parks.

The Times thinks that the situation in some states is really bad. They think the feds will have to bail out the states, but admit that this will be difficult given the current political climate. Last year, the feds paid ONE THIRD of state budgets! This has gotta stop!

Mounting State Debts Stoke Fears of a Looming Crisis

The budget imbalances and debt in states and localities remind some analysts of the run-up to the subprime mortgage meltdown, or of the crisis hitting Europe.

http://www.nytimes.com/2010/12/05/us/politics/05states.html?nl=todaysheadlines&emc=a2

The State of Illinois is still paying off billions in bills that it got from schools and social service providers last year. Arizona recently stopped paying for certain organ transplants for people in its Medicaid program. States are releasing prisoners early, more to cut expenses than to reward good behavior. And in Newark, the city laid off 13 percent of its police officers last week.

While next year could be even worse, there are bigger, longer-term risks, financial analysts say. Their fear is that even when the economy recovers, the shortfalls will not disappear, because many state and local governments have so much debt — several trillion dollars’ worth, with much of it off the books and largely hidden from view — that it could overwhelm them in the next few years.

“It seems to me that crying wolf is probably a good thing to do at this point,” said Felix Rohatyn, the financier who helped save New York City from bankruptcy in the 1970s.

Some of the same people who warned of the looming subprime crisis two years ago are ringing alarm bells again. Their message: Not just small towns or dying Rust Belt cities, but also large states like Illinois and California are increasingly at risk.

Municipal bankruptcies or defaults have been extremely rare — no state has defaulted since the Great Depression, and only a handful of cities have declared bankruptcy or are considering doing so.

But the finances of some state and local governments are so distressed that some analysts say they are reminded of the run-up to the subprime mortgage meltdown or of the debt crisis hitting nations in Europe.

Analysts fear that at some point — no one knows when — investors could balk at lending to the weakest states, setting off a crisis that could spread to the stronger ones, much as the turmoil in Europe has spread from country to country.

Mr. Rohatyn warned that while municipal bankruptcies were rare, they appeared increasingly possible. And the imbalances are so large in some places that the federal government will probably have to step in at some point, he said, even if that seems unlikely in the current political climate.

“I don’t like to play the scared rabbit, but I just don’t see where the end of this is,” he added.

Resorting to Fiscal Tricks

As the downturn has ground on, some of the worst-hit cities and states have resorted to fiscal sleight of hand to stay afloat, helping them close yawning budget gaps each year, but often at great future cost.

Few workers with neglected 401(k) retirement accounts would risk taking out second mortgages to invest in stocks, gambling that the investment gains would be enough to build bigger nest eggs and repay the loans.

But that is just what Illinois, which has been failing to make the required annual payments to its pension funds for years, is doing. It borrowed $10 billion in 2003 and used the money to invest in its pension funds. The recession sent their investment returns below their target, but the state must repay the bonds, with interest. The solution? Illinois sold an additional $3.5 billion worth of pension bonds this year and is planning to borrow $3.7 billion more for its pension funds.

Now the Times says California is broke again.

Fiscal Woes Boomerang for Brown in California

By now, Gov. Jerry Brown had hoped to have dispensed with huge budget shortfalls, not be facing another one.

http://www.nytimes.com/2012/05/15/us/brown-proposes-8-3-billion-in-cuts-for-california.html?nl=todaysheadlines&emc=tha23_20120515

He's trying to cover up the problem, of course:

"It's a pretzel palace of incredible complexity."

GOV. JERRY BROWN, on California's budget, which calls for severe spending cuts to deal with a $15.7 billion shortfall. NYT quote of May 15

It's not all that complex. Public sector unions have pushed pay and pensions beyond what the state can pay. Unless they're cut, the state will go down. What's complex about that?