Obama Redistributes True To Form

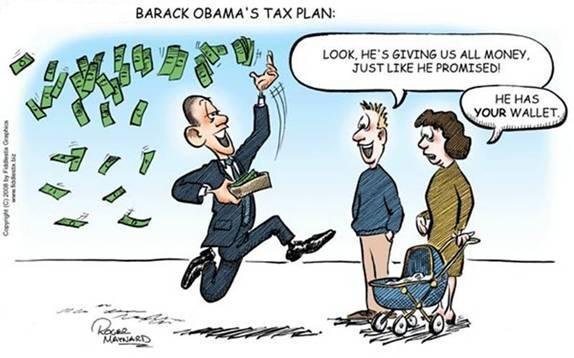

It's all the government's money to spend as Obama thinks best.

-

Tools:

Whatever else he is, Mr. Obama is consistent. For years now, he's faithfully stuck with his mantra of "tax the rich." He says that everything would be all right if only the rich would pay their "fair share."

That's nonsense on stilts. Confiscating Bill Gates' entire $50 billion - that is, scarfing up all his assets, not just his income, and flinging him onto the street in his nerdly whitie-tighties - would run the government for less than a week. Doing the same to Warren Buffet would run the government less than 4 days.

Then what? "The rich" alone simply do not have enough money to support Mr. Obama's current spending but nobody in the mainstream media will say so.

Tax 'Em Here, Tax 'Em There...

The New York Times reports that Mr. Obama wants to "tax the rich" in Europe, too:

The Obama administration, increasingly alarmed by the spillover effects of Europe’s financial crisis, has begun an intensive lobbying campaign to persuade Chancellor Angela Merkel of Germany and other leaders to ramp up efforts to stem any contagion from the debt crisis in Greece. [emphasis added]

There is a "debt crisis" in Greece. On May 23, 2010, the New York Times said,

"The deficit crisis that threatens the euro along with an aging population and low growth has undermined the sustainability of Europe's standard of social welfare."

That's a colossal understatement. When the post-nationalistic, pan-European crowd set up the Euro, they spread the fiction that all Euro debt was the same. Countries like Greece could borrow Euros to cover ridiculously-high government salaries, overmanning, and early pensions without raising taxes. They paid no more interest than the Germans because lenders bought the lie that all Euro-denominated debt was the same.

The crisis came when lenders realized a) Greek debt was far too high for Greece to pay no matter what they did and b) there was no guarantee that the rest of Europe would pay it for them. They demanded higher interest and started refusing to roll over loans.

Instead of letting lenders take a haircut through Greek default, the rest of Europe threw billions of Euros into the Greek rathole over the past 18 months. In exchange, the Greeks promised to cut spending, rationalize taxes, sell government-run businesses, and reduce regulation so the private sector could create jobs.

Such measures are known to work; they turned around overspending cities like Boston and San Francisco in times past. Unfortunately, the Greeks didn't keep their promises: faced with riots in the streets, the Greek government hasn't make enough cuts and probably never will as long as other people keep paying paying the bills.

Ramp Up Efforts...

Mr. Obama wants Germany and France to "ramp up efforts to stem any contagion from the debt crisis..." He wants "the rich" in Germany and France to take on more Greek debt by paying off the current lenders. The Germans and French should get the money back from Greece at some point in the future, about when Mr. Obama's future spending cuts kick in. Or should we say "if"?

In phone calls and meetings over the last week, President Obama urged Mrs. Merkel and President Nicolas Sarkozy of France to take coordinated measures — including spending billions in additional funds to bail out Greece and bolster European financial institutions — to prevent Greece’s debt woes from spreading to its neighbors. [emphasis added]

Where will "billions in additional funds" come from? From "the rich" German and French taxpayers, of course.

This is Presidential Politics in its purest form:

Kenneth Rogoff, a Harvard economist who has written about the history of financial crises, puts Europe’s effect on the United States in blunt political terms. “The downside scenario is awful,” he said, “and if it happens before the U.S. election, it would turn a toss-up election into one in which the president is a huge underdog.

Obama hasn't forgotten that the crisis of 2008 turned Mr. McCain into a "huge underdog;" he'll do anything to prevent it happening to him.

“The administration’s hope is that the Europeans will kick the can down the road far enough that it gets past the election,” said Mr. Rogoff, who has advised Mr. Obama and Republicans.

The Multi-Billion Euro Rathole

"The rich" Europeans may cough up yet again, increase government borrowing, and lend the Greeks yet more. They've done that since the crisis started 18 months ago; why not yet again?

This will be difficult for the same reason Mr. Obama couldn't get the spending bills he wanted - voters are grumpy. The $600 billion they put in wasn't enough and "the rich," which includes all taxpayers in Germany, France, and Britain, don't want to put in any more:

Mrs. Merkel [head of the German government] faces daunting political obstacles — which Mr. Obama fully recognizes, this official [another anonymous source] said — in persuading the German public to spend hundreds of billions of euros to bail out Greece and potentially other Mediterranean countries. [emphasis added - Italy and Portugal are in financial trouble, Ireland has been for years, and nobody knows who else might break.]

How can "the rich" be so heartless? Why would taxpayers worry about getting paid back? Won't Greeks cut spending as Germans did, share sacrifice between management and labor as Germans did, raise retirement age as the French did and British are trying to do, relax job-killing regulations, grow their economy, and pay everybody?

This is because human beings are not natural socialists - they're reluctant to personally sacrifice for the convenience of someone else who've they've never met, or even for the long-term well-being of their own country. The Wall Street Journal reported on September 23, p A5:

Thousands of Greek public-transport workers walked off the job Thursday in a 24-hour strike over new austerity measures, a day after the government approved fresh budget cuts to appease the country's international creditors.

Transit workers aren't alone - taxis, teachers, air traffic control, and other groups are following up past street riots with strikes.

After a year of watching spending cuts not happen as promised, lenders who set up the $600 billion bailout fund are threatening to withhold $8 billion unless Greeks change now.

Ordinary Greeks who've lived high at European expense want benefits to keep flowing. The Greek government probably hopes that Europe would rather pay billions more than let the Euro collapse. They may not cut much more if at all. Sound familiar?

An Explosive Mix

Europe going down might hurt our economy enough to swing the election to "anybody but Obama." Besides, "the rich" have plenty of money and should be forced to share, Mr. Obama says.

Having been told that a one-currency Europe would provide more jobs and achieve financial stability, European voters have found that these promises are nothing but pixie dust. Voters were told $600 billion would be enough; it wasn't. Given riots, why would anyone believe Greek promises about spending cuts?

Germans who remember taking a wheelbarrow-load of bank notes to buy a loaf of bread sense a whiff of currency debasement in the air and yearn to return to the Deutchmark. British politicians know that Obama's new Greek bailout will need billions from Britain. Some are urging their government to ask British voters whether they should leave the European Union entirely.

Presidential Pontification Rides Again

Pontificating about having "the rich" bail out the Greeks again in the name of "fairness" comes easily to Mr. Obama. It's not his taxpayers who'd pay billions, it's not his electorate who'll "vote the rascals out" when Greece goes sour.

He's switched to "campaign mode." If Europe goes down, he's less likely to get re-elected. He'll throw any number of "rich Europeans" under the bus to help his prospects.

There's no way the Greek economy can grow enough to pay off Greek debt and pension obligations no matter what. Greeks can't keep their promises any more than we can pay USA Today's estimated half-million per household to cover US debt.

The yield on two-year Greek notes just rose to 69.7 percent; investors seem to think default is less than two years away; they want their money back fast. We believe there will be default either by explicit write-off or by inflation. Investors and pensioners will take a haircut. The more money they throw down the Greek rathole now, the worse the default will be.

The question is, will European leaders scent "Tea Party" in the air and be careful with their taxpayers' money? Or will they throw good money after bad and hope the crash comes after they've left office?

At least we don't hear European politicians promising to fix everything by taxing "the rich." American newspapers are covering for The One, but European papers would never let their politicians get away with saying anything so silly.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

The Economist recently estimated that a €100-200 billion loss to Europe from another "fix it" bailout would hurt less over all than the €1-2 trillion loss that would inevitably come (their words) from Greece returning to the drachma, dumping their creditors.

What the Economist ignored (or perhaps failed to remember) was that their **is no end** to the continual cycles of bailouts Greek can impose on Europe.

Politicians constantly fail to consider the long-term effects these "moral hazards" create. Greece dumping the euro is bad **now**. But it fixes the long-term problem.

Whan has any politician thought beyond the next election?

Offensicht... You're a genius! I had not thought of the election angle here, but it makes a lot of sense. Europe continuing to riot/bailout/decline will remind American voters what they want to avoid. Obama needs a quiet dulcet Europe come Nov 2012.

Well, they kicked the can down the road until October, when the Germans have to vote again to give them yet more billions.

Nothing seems to work.

NYT agrees that it isn't enough - another hundred billion is only enough for a few days! Like US govt spending.

They're saying that these stopgaps won't make realistic solutions. What do they think would be a realistic solution? Fire government employees? Whack pensions? Or just raise taxes?

http://www.nytimes.com/2011/09/30/opinion/more-stopgap-measures-wont-save-europe.html

The German Parliament’s move to expand the euro-zone bailout fund on Thursday is welcome, but the European debt crisis is no closer to resolution than it was two months ago. Even with Germany’s roughly $287 billion increased contribution, the fund is still too small to provide more than a few days of calm to jittery markets.

The big picture, in fact, has gotten much worse. Greece’s indebtedness is growing, European bank balance sheets are shakier and investors are increasingly skeptical that Europe has the will to stabilize shaky credit and stock markets. Also conspicuously lacking is any clear plan for generating the economic growth needed to begin paying down those growing debts.

Instead, heavily indebted nations are yielding to pressure to embrace more of the austerity medicine that will only make them sicker. On Tuesday, Greece voted to impose a steep new property tax. On Wednesday, the European Parliament tightened the noose by approving new financial penalties for countries running high deficits.

Timothy Geithner, the Treasury secretary, and finance ministers from around the world were uniformly critical of European finance ministers at last weekend’s annual meetings of the World Bank and International Monetary Fund in Washington. They rightly fear that Europe’s serial mismanagement of its debt problems has become a grave threat to global recovery.

Mr. Geithner asked for a more financially powerful bailout fund along with short-term stimulus from Europe’s wealthier economies. But his ability to persuade has been undercut by House Republicans who insist on imposing untimely austerity on the United States.

Even if all remaining countries, which include Austria, Slovakia and the Netherlands vote to strengthen the bailout fund, it will still be limited to roughly $600 billion, not nearly enough to quiet the crises building over Italy’s debt, France’s weakened banks and looming trouble elsewhere. Europe needs a completely different approach, like increasing the bailout fund’s lending capacity to $2 trillion or $3 trillion, either through direct contributions or leveraging its existing balances by borrowing against them.

A growth strategy would mean easing up on austerity for Greece and other weakened economies and enacting stimulus measures in every European Union country that can afford it — chiefly Germany, France and Britain. Yet these three economies are going in the opposite direction.

This week’s crisis-containment measures may steady the markets for a bit, but by failing to deal with the underlying problems they delay more realistic solutions.