The Dreadful Pain of Cuts

Slashing expenses really hurts - but bankruptcy hurts worse.

-

Tools:

Throughout the course of the Great Recession, your humble correspondent has been inordinately blessed and fortunate.

I have not suffered a single day of unemployment. I have not had my hours cut back at work, nor my salary slashed; on the contrary, it has increased along with my responsibilities.

From living in an apartment, my family has moved through renting a house and now into our own purchased property, thanks to the real estate price collapse which brought prices down to affordable levels. We also had the chance to buy a brand-new car, something I thought we'd never do, because of automaker desperation and negligible interest rates.

All in all, it's been a really good recession for me. So I must be sitting in clover, right, watching my wealth grow?

No! Buying a house is fantastic in the long term, but in the short term it's a difficult business - especially when it's a foreclosed place in need of a serious overhaul. Getting a great deal on a new car is wonderful, but the monthly payment is still twice that of a used car.

The bottom line? As the sages of old said, "When riches increase, there increase them that eat them." I'm making more than I ever have - and I owe more than I ever have, have more long-term obligations than I ever have, and it's pretty much a wash financially.

There is, however, one difference. When I had less money and fewer obligations, a financial disaster would have been less quantitatively disastrous precisely because I had fewer obligations.

Now, though, what would happen if I suddenly lost my job? Where do you cut?

Give the car back - and lose the large amount already invested in it, no doubt still owing a balance and being left with no car? Wait for the bank to foreclose on the house, renovations half-completed and the selling price thus depressed? Stumble around in the dark to save on the electric bill?

The problem is, our life is arranged around a certain way of living and all the pieces interlock inextricably. You can't readily cut back in any one area; you have to do a complete overhaul with ruinous transition costs, fought tooth and nail by the various family vested interests who don't want their particular ox gored while the ship continues to sink.

Sometimes it's the little things that hurt the most. A major coffee chain has an ad series out, "Take Comfort in Rituals" - reflecting that millions of Americans have established a daily ritual of drinking their overpriced brew every day. Today, sales are plummeting; hard on the chain, but just as hard on the people who really loved that particular ritual and now can't afford it anymore.

With luck I'll never be faced with this kind of desperate quandary in my personal life, though the odds aren't in my favor.

Unfortunately, our nation is already in this position.

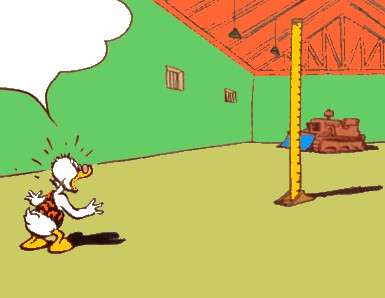

|

| Our national treasury. |

More Than We Can Ever Pay

Americans are by now well aware of the Federal government's gargantuan annual deficit. It's been unimaginably huge for most of our lifetimes, barring a few years under Clinton with a Republican Congress; now it's unimaginably huger.

It is, in fact, so vast that it cannot be eliminated by anything resembling normal means. Our annual government deficit is currently running just about equal to annual tax revenues - in other words, the government is spending twice what it's taking in. The left talks about cutting defense; if we got rid of defense entirely, the deficit would almost (but not quite) be eliminated.

The right talks about cutting welfare and extra-Constitutional functions. This has the merit of actually working mathematically; if the Federal government paid for nothing but national defense, including border patrol and customs, our current tax revenue would pay the bills with a bit left over to work down the existing debt.

Does anybody think that cuts of that magnitude are likely? Not cutting Medicare, Medicaid, Social Security - getting rid of them all, along with the EPA, almost all Cabinet departments, and hundreds of thousands of government bureaucrats.

Yet that's the only way to balance the budget on existing tax revenues.

Nobody will be surprised to hear that the Democrats would rather simply raise taxes to cover whatever they want to spend. According to economists, though, that won't work either: the government is already collecting the maximum amount of cash possible from our economy at its current size.

We are on the peak of the Laffer Curve - in other words, if the government raises taxes it will actually get less money because the tax is now so high that it destroys economic activity. Pushing it higher will destroy even more and tax revenues will go down instead of going up.

Barack Obama ought to know this. His own first chair of the Council of Economic Advisers, one Christina Romers, studied the effects of taxation on economic growth and recessions. In somewhat opaque academic-ese, she wrote:

...the behavior of real GDP following an innovation of one percentage point to our series of exogenous tax changes [i.e. tax increases] ... The estimated maximum effect is a decline of 2.93 percent [of the economy] after ten quarters ... the effect falls to -1.84 percent after 15 quarters, and then remains roughly at that level.

Let's put it in plain terms: Raise taxes by 1% of GDP and you get a GDP that's almost 3% smaller than it would have been in the short term, and almost 2% smaller in the long term.

Economics is not an exact science. There are functional nations in Europe with higher tax rates than we have, so it's possible that we could raise taxes somewhat and "get away with it." Even if it were politically possible, though, we literally cannot double tax revenues - yet we're spending as if we could.

Of course, there is always another way: increase tax revenues by expanding the economy. This worked marvelously for President Reagan; his growing deficits were handled because the boom was even bigger. Again, though, do we expect to double the size of our economy anytime soon?

Our Only Hope: The Hatchet

It is theoretically possible that I'll win the lottery - someone would have to give me a winning ticket since I don't buy them myself, but it's possible. I would be a fool to base my spending plans on that happening, however.

It is also possible, and a lot more likely, that I'll find a job paying me twice as much as I already earn. Being "a lot more likely" than winning the lottery is not exactly a ringing endorsement; again, nobody sane would count on such good luck.

In my case, I can only hold down spending as tightly as possible while hoping nothing happens to my job.

For our nation, no such luck; financially speaking, we're already unemployed but we're spending more than we did when we were working. People can declare bankruptcy and start over; nobody wants their country to go through that.

The only way to avoid it is an unprecedented slashing - not trimming, not cutting, but a scorched-earth wholesale demolition of government programs. Yes, we need to get rid of the ruling socialists this November, but that will be only the merest of beginnings.

There will be pain; the only question is, will we rationally decide on and plan for the pain? Or will it happen randomly as things fall apart? As unpleasant as it would be, I'd rather the former.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

"not trimming, not cutting, but a scorched-earth wholesale demolition of government programs"

That has a nice ring to it.

If you have debt you are not living within your means.

The greatest minds America has to offer encourage people to use debt responsibly. What does that even mean, really. Don't owe more than you can afford the payments for? Really? How about Saving money. Anyone? no? No one. I will have what I want and I want it now. To Hell with the future.

That includes houses and cars. If you can't pay cash you can't afford it.

When fiscal responsibility is defined as not having more debt than you can afford the end is, indeed, nigh. It would appear that democracy truly is a failed experiment